how to put instacart on taxes

For 2020 the mileage reimbursement amount is 057. For Instacart to send you a 1099 you need to earn at least 600 in a calendar year.

What You Need To Know About Instacart Taxes Net Pay Advance

There will be a clear indication.

. Depending on your state youll likely owe 20-25 on your earnings from instacart. Put 20 away for the just in. Up to 5 cash back Get unlimited year-round tax advice from real experts with TurboTax Live Self-Employed.

Learn the basic of filing your taxes as an independent contractor. This means for every mile you drive you pay 057 less in. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits.

Youll be getting a 1099 from Instacart in early 2021 for the 2020 tax year. There is a 45 late. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly.

Estimate what you think your income will be and multiply by the various tax rates. Gig workers must pay federal income taxes and a 153 self-employment tax on earnings above 400. Youll need to create an account and agree to e-delivery ie agree to receive your 1099 tax form electronically via Stripe Express to preview and download your 1099 tax form.

Instacart is however not required to provide a 1099 form. Accurate time-based compensation for Instacart drivers is difficult to anticipate. Youll include the taxes on your.

Fill out the paperwork. Part-time employees sign an offer letter and W-4 tax form. Stride Tip If you ever owe more taxes than you can afford and youre not able to pay your entire owed tax on time make sure to file your tax return anyway.

Your 1099 tax form will be available to download via Stripe Express. The other boxes are for business that are incorporated as entities. Even if you made less than 600 with Instacart you must report and pay taxes on your income.

Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year. As an independent contractor you must pay taxes on your Instacart earnings. You expect your withholding and credits to be.

First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099. With TurboTax Live youll be able to get unlimited advice. Instacart delivery starts at 399 for same-day orders 35 or more.

First make sure you are keeping track of your mileage. If your Instacart job is a side gig then you would check the box for IndividualSole Proprietor. Missouri does theirs by mail.

Here you will claim your gross income from the business deduct any expenses to calculate the net business income and report the GSTHST paid if applicable. The organization distributes no official information on temporary worker pay however they do. Be sure to file separate Schedule C forms for each separate freelance work that you do ie.

Pay Instacart Quarterly Taxes. Tax tips for Instacart Shoppers. This includes driving for Uber or Lyft delivering food or groceries or.

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. Independent contractors have to sign a contractor agreement and W-9 tax form. Your 1099 tax form will be mailed to you if you dont receive an email from Stripe or dont consent to e.

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Just Gave Grocery Retailers The Keys To The Castle

Instacart Q A 2020 Taxes Tips And More Youtube

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

Top 10 Tax Deductions For Instacart Personal Shoppers 2022 Instacart Shopper Taxes Taxes S2 E82 Youtube

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

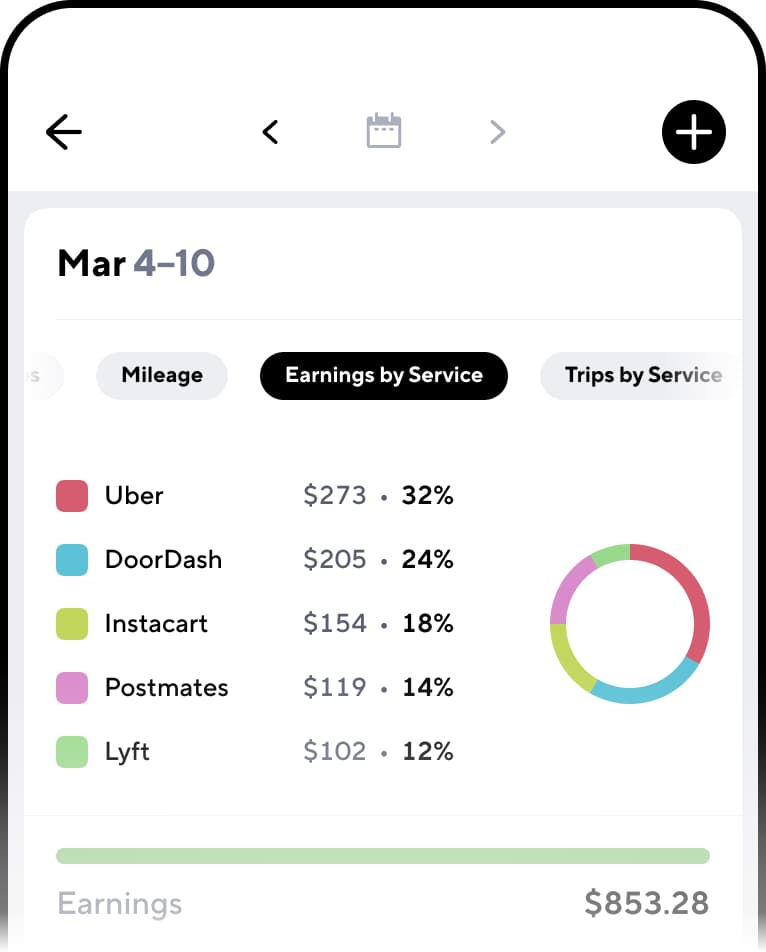

Gridwise Instacart Mileage Tracking For Instacart Shoppers

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Guide To 1099 Tax Forms For Shipt Shoppers Stripe Help Support

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

First Time Ordering Instacart As A Customer Usually A Shopper Why In The Hell Is There Such A Massive Service Fee And Why Is It More Than The Payout Of Some Batches

How Much Can You Make A Week With Instacart 2022 Real Earnings

Instacart Reviews 2 006 Reviews Of Instacart Com Sitejabber

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

When Does Instacart Pay Me A Contracted Employee S Guide

Does Instacart Track Mileage The Ultimate Guide For Shoppers